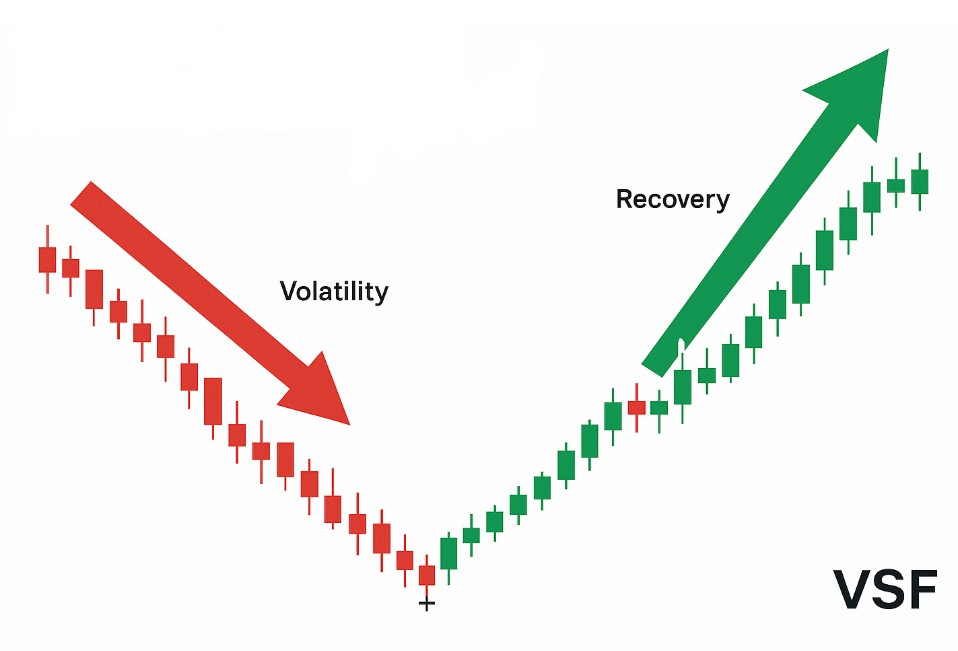

What Can Go Right? Navigating Market Volatility I have been paying attention to the uncertainty that we are currently living in, and I’m impressed by how many of you have reached out to ask if this is a good time to invest more. My approach to today’s environment is to focus on what I can control within our four walls and adapt only when there is a pivotal change. I…